Asset Management

Back in Black: S&P 500 Hits All-Time High

The S&P 500 finally closed above the prior all-time high, which was on January 3, 2022, on the eve of the start to that year's bear market. The Dow and Nasdaq 100 followed suit with their own all-time highs. After finding some footing with a 26% rally between late October and late December, the Russell 2000 index of small cap stocks suffered a 7% pullback and is still 20% shy of its November 8, 2021 all-time high.

Ironically, the absence of a formal recession could be put in the "plusses" column for stocks recently. Per a recent Leuthold Group study, there have been 16 major advances in the S&P 500 since 1957, with the life expectancy of each heavily dependent on whether or not it was preceded by a recession. In the eight cases when the upswing began in the throes of an economic downturn, the index gained an average 135% over 45 months. Conversely, when the preceding S&P 500 decline was not associated with a recession, the subsequent advance was not as powerful at 75% on average over 35 months. The distinction likely rests heavily on the Federal Reserve policy reaction function (easier monetary policy to combat recessions).

Looking under the hood of performance

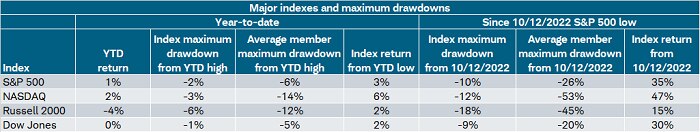

The table below highlights two periods: the left half representing year-to-date 2024 and the right half representing the period since the S&P 500's October 12, 2022 bear market low. What's perhaps most interesting aren't the headlines noted above, but the innards of performance. Just this year, the average member (of each index) maximum drawdown from this year's high has actually been in correction territory for both the Nasdaq and Russell 2000: -14% and -12%, respectively.

Source: Charles Schwab, Bloomberg, as of 1/19/2024.

Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results. Some members excluded from year-to-date return columns given additions to indices were after January 2024.

Culprit of boomerang performance

In terms of market breadth, the bloom has come a bit off the rose, following the surge in the percentage of stocks trading above their 50-day moving averages. As shown in the first chart below, from a low south of 20% in late October 2023 to about 90% in the case of the S&P 500 and Russell 2000 (less of a surge in the Nasdaq), a touch of halitosis has kicked in this year, especially for the Nasdaq and Russell 2000. The second chart highlights that the outperformance of the Russell 2000 was short-lived and has given way to S&P 500 outperformance yet again.

Breadth rolling over again

Source: Charles Schwab, Bloomberg, as of 1/19/2024.

Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

Large caps flexing muscles again

Source: Charles Schwab, Bloomberg, as of 1/19/2024.

Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

As shown below, at the sector level, breadth has been weakest in the Utilities and Energy sectors, with Financials in the lead. Financials have gotten a lift from a steepening (albeit still inverted) yield curve, and an improving earnings profile. Utilities' extreme weakness is perhaps easy to explain given the recent run-up (yet again) in bond yields (making yield-oriented, but more volatile sectors less attractive). In the case of Energy's weakness, it's less about oil prices (trending higher since mid-December) and more about the sector's weak earnings profile.

Financials with freshest breadth

Source: Charles Schwab, Bloomberg, as of 1/19/2024.

S&P 500 sectors shown. Past performance is no guarantee of future results.

Bond yields and expectations around Federal Reserve policy continue to be in the equity market's driver's seat, especially since last summer. The run-up in the 10-year Treasury yield from sub-4% to 5% between mid-July to mid-October was a direct contributor to the correction in the major equity market averages between late July and late October. The recent bullwhip higher in bond yields has tended to hurt small cap stocks disproportionally given smaller companies' greater sensitivity to higher financing costs.

In turn, the swift drop in yields—which brought the 10-year yield back below 4% by late December—meant a very broad stock market rally. In fact, during the two-month rally phase, the S&P 500 Equal Weighted Index bested the performance of its cap-weighted S&P 500 brethren. Shown below is the tightening up—since last July's yield trough—of the inverse relationship between moves in the 10-year yield and the equal weighted S&P 500 index.

Yields' impact on equal weight

Source: Charles Schwab, Bloomberg, as of 1/19/2024.

Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

Breaking up the band?

The central market theme last year was the dominance of the Magnificent 7 (Mag7), given the group—when measured as one index—rose by more than 100% and gave a significant boost to the overall market's return. Despite the turn of the calendar, focus on the Mag7 has not faded. It's not unjustified, given three of the members—Microsoft, NVIDIA, and Meta—made new all-time highs alongside the S&P 500 on January 19th.

It's quite a different story for some other members, though. As shown below, in terms of the current maximum drawdown from recent highs, Amazon and Tesla stand out in a not-so-good way. The former is still near bear market territory while the latter is sitting nearly 50% below its all-time high.

Mag7 not moving as one

Source: Charles Schwab, Bloomberg, as of 1/19/2024.

All corporate names and market data shown above are for illustrative purposes only and are not a recommendation, offer to sell, or a solicitation of an offer to buy any security. Supporting documentation for any claims or statistical information is available upon request. Past performance is no guarantee of future results.

We've written several times on the risks of approaching today's market in a monolithic sense, especially when it comes to the Mag7. Not only are they not housed in the same sector (they in fact span Information Technology, Communication Services, and Consumer Discretionary), but the chart above shows that they haven't exhibited the same performance pattern.

Last year, the Mag7 were often lauded as the market's best performers, but that's far from reality. Consider the fact, according to Bloomberg data, that there were 62 members of the S&P 500 that outperformed Apple (the world's largest company by market cap) last year. Perhaps "magnificent" as a descriptor is in the eyes of the beholder; it certainly applies to the size of these companies, but not the performance for every member. In fact, this year so far, you have to go down to the 495th ranking out of the 500 stocks in the S&P in order to capture all seven of the Mag7.

While we don't analyze individual names, it's clear that the Mag7 are often favored by investors because the group exhibits several high-quality factors (a.k.a. characteristics)—such as a strong cash position, high interest coverage, and a healthy balance sheet. It's likely a driving force behind their becoming the pandemic era's "defensive" names. As such, debate has stirred as to whether the Mag7 will suffer if the economy escapes a recession. We don't think a binary tradeoff—where the Mag7 must underperform for the rest of the market to do well—is necessary. Money doesn't have to funnel out of one group into another.

Cash rules (the narrative)

Speaking of the movement of money, that brings us to another narrative that has dominated the conversation of late: the massive pile of "cash on the sidelines." With rates having risen so rapidly over the past couple years, investors have found generous returns in money market funds (MMFs), with assets therein hitting $6 trillion, as shown with the blue line in the chart below.

However, there are several flaws associated with the narrative that this buildup in cash will be dwindled and then funneled into the stock market—powering equities even further. As the yellow line below shows, the amount of money market fund assets as a percentage of the S&P 500's market cap is low relative to prior instances during which cash was being built up at a significant rate. When looked at in the context of how much the stock market has grown, the "firepower of" cash hasn't increased at all over the past decade.

Cash's (perceived) firepower

Source: Charles Schwab, Bloomberg, Investment Company Institute (ICI), as of 1/19/2024.

Another flaw in the sidelined cash narrative is the assumption that movements in money market funds and the stock market are always inversely correlated. As shown in the chart below, there have been several periods during which stocks have performed well even as money market fund assets were growing. Most notable was during the strong equity bull run in the late 1990s when the rolling six-month percentage change in both the S&P 500 Index and Investment Company Institute (ICI) money market assets stayed positive for several years.

Market not at odds with cash

Source: Charles Schwab, Bloomberg, Investment Company Institute (ICI), as of 1/19/2024.

Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

Lastly, we'd point out that there is no hard and fast rule stating that cash must be put into the equity market. For investors who might be looking for more stable streams of income, several pockets of the fixed income market look attractive. Bond yields are high relative to history (especially for investors who weren't in the market before the Global Financial Crisis). Not only that, but as our colleague and chief fixed income strategist, Kathy Jones, pointed out in her 2024 outlook, total return prospects for bonds have improved quite a bit over the past year.

Stocks don't need the buildup in investors' cash positions to fall in order to do well. Always and especially in the current environment, we think the economic, monetary policy, and corporate profits trajectories are far more important in determining the health of the market.