Asset Management

Election Risk Returns

In our 2024 Outlook and in our recently published Mid-Year Outlook, we identified elections as a top risk for investors this year, likely bringing the return of volatility from some of the lowest levels measured by the stock market volatility indexes in the U.S. and Europe (VIX and VSTOXX) in decades. Volatility jumped last week in reaction to the decision by French President Macron to call a snap election to be held at the end of June, after his party had disappointing results in the European Parliamentary elections. The move risks an abrupt change in domestic leadership that could worsen France's already stretched budget deficit. French government bonds sold off and took the banks that own them along for the ride. The volatility could continue with the French election still weeks away and more elections in other countries for investors to consider over the remainder of the year.

Stock market volatility is rarely as low as it was heading into last week

Source: Charles Schwab, Bloomberg data as of 6/16/2024.

The volatility index is based on the prices of options on the S&P 500 (VIX) and Euro STOXX 50 (VSTOXX) indexes and is calculated by aggregating weighted prices of the index's call and put options over a wide range of strike prices to assess the market's expectation about volatility over the next 30 days.

Budget blowout

The gain of 30 seats by far-right parties in the European Parliament out of 720 seats with 60% still held by the centrist coalition means that policy may shift slightly to the right—but most likely only in language, as European laws are also approved by the European Commission before being implemented. Most European policy is still decided at the country level. While we believed a shift to the right in the election was likely, the surprise was French President Macron announcing a national election on June 30 with a run-off on July 7. The election will determine the next prime minister of France.

A win by France's populist National Rally party would put them in control of France's domestic priorities and spending. Their proposals seem expensive: boosting pension payouts (reversing President Macron's pension reform and lowering the retirement age to 62 from 64), cutting the Value Added Tax or VAT (on food, electricity, and gas), exempting younger workers from income taxes, and a "Buy French" policy that goes against EU rules.

Rating agency Standard & Poors recently downgraded France's debt from AA to AA-. France's budget deficit currently sits around 5% of GDP and is expected by the International Monetary Fund to remain above the Eurozone's stated 3% threshold through the end of the decade. There doesn't seem to be much room for additional spending. Although other advanced economies including the U.S., U.K., and Japan are also projected to have similar deficits in the years ahead, France could have the widest deficit among them if expensive proposals are implemented.

Budget deficit 2019-29 as percentage of GDP

Source: IMF Fiscal Monitor April 2024.

https://www.imf.org/-/media/Files/Publications/fiscal-monitor/2024/April/English/text.ashx Forecasts contained herein are for illustrative purposes only, may be based upon proprietary research and are developed through analysis of historical public data.

Overreaction?

Even though we've been highlighting the election risks for investors all year, we also believe that markets tend to overreact in the near term when surprised with a risk they may not have had foremost in mind. Consequently, we are cautious about selling into the drop that has the eurozone financials sector (MSCI EMU Financials Index) down 8% so far this month, as measured in U.S. dollars.

The markets seem to be treating "Le Penonmics" (after Marine Le Pen, the President of France's National Rally party) the way they treated "Trussonomics," when U.K. Prime Minister Liz Truss's unfunded spending plans led to a sharp selloff in U.K. government bonds and stocks. As events unfolded in September and October 2022, all three major bond rating agencies (Standard and Poors, Moody's, and Fitch) lowered their outlook for the credit rating on U.K. government debt to "negative" from "stable." In that 2022 scenario, the stock market sell-off was quickly reversed when spending plans were rescinded in response to the market backlash. The FTSE 100 Index of U.K. stocks fell nearly 10% from August 19 to October 12, 2022. Then as Truss resigned and the Conservative party abandoned its fiscal spending plans, the stock market fully recovered by the end of November 2022.

Trussonomics drop and rebound

Source: Charles Schwab, Bloomberg data as of 6/16/2024.

Indexes are unmanaged, do not incur management fees, costs, and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

Now, in France, a second-round vote on July 7 that keeps the National Rally from power or a more budget-friendly change in the party's proposals brought about by market forces could lead to a market rebound. Already last week members of the National Rally seemed to be backing away from the pension reversal in public statements. But these possibilities are still a few weeks away and the near-term market pressure may need to get worse before it drives changes in the polling or plans.

Impact on rate cuts?

The election and market moves are unlikely to impact the European Central Bank's (ECB) decision making for several reasons:

- The National Rally is not campaigning on leaving the eurozone. Although the euro is down 3% this year versus the U.S. dollar, including a dip of just 1.3% so far in June, that move does not seem to be a shock plunge reflecting a crisis tied to an existential threat to the eurozone, but primarily the result of different trajectories of central bank policy rates.

- Although the spread between France and German 10-year bond yields has widened dramatically this month, it seems to be the result of a drop in German yields rather than a worrisome climb by those in France.

Wider bond spread but lower yield for France

Source: Charles Schwab, Bloomberg data as of 6/16/2024.

Indexes are unmanaged, do not incur management fees, costs, and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

- Inflation continues to ease toward the ECB's 2% target as the economic recovery continues.

France's political travails are unlikely to prompt a crisis that would require another rate cut by the ECB in July. Inflation is near target, and it seems that the ECB can afford to wait until September for more data and updated economic projections before taking additional action.

Takeaways for investors

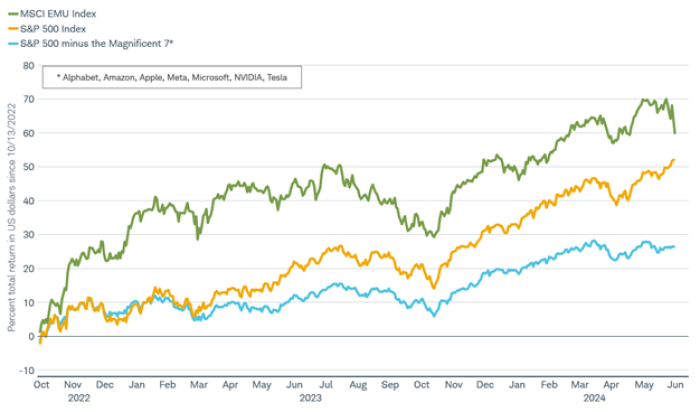

- European stocks still outperforming. It may seem that things have gone from bad to worse for investors in European stocks given the 2023 recession, lingering weakness in the euro, election risks, and potential for Chinese reciprocal tariffs on EU exports. The return of volatility, absent during much of the first half of the year, is likely to continue. We believe stocks across the eurozone can post gains in the second half of the year as building momentum in manufacturing and European Central Bank rate cuts combine with rising earnings estimates to lift stock prices from still attractive valuations. Even though they have given up ground this month, European stocks as represented by the MSCI EMU Index are still outperforming the S&P 500 by 8 percentage points since the current bull market began in mid-October 2022, when measured by total return in U.S. dollars. That performance is even wider at 33 percentage points when measured excluding the Magnificent 7 stocks. Notably, while European banks had a very tough June, they remain ahead of U.S. banks since the bull market began by 76 percentage points, measured by total return in U.S. dollars for the MSCI EMU Banks Index and the S&P 500 Banks Index.

Performance since current bull market began in October 2022

Source: Charles Schwab, Macrobond, S&P Global, MSCI as of 6/16/2024.

All names and market data shown above are for illustrative purposes only and are not a recommendation, offer to sell, or a solicitation of an offer to buy any security. Indexes are unmanaged, do not incur management fees, costs, and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

- Risk to China exporters. In both France and the eurozone, the executive branch (President and European Commission respectively) imposes trade protection measures, not parliament. But parliament's rightward shift could have influence. The EU is already imposing tariffs on Chinese electric vehicles, and broader measures could gain more support. Any policy retaliation by China may hurt European auto stocks which took a hit recently on prospects for higher Chinese tariffs. China could also target makers of luxury goods, wine, and airplane parts.

- Risk to financial stocks. The big European and French banks own a lot of government debt and there is the potential for less momentum toward further fiscal integration in Europe that could widen government bond spreads. During the COVID-19 pandemic the EU took unprecedented steps towards a fiscal union with an 800 billion euro recovery fund. France was a key player in making that happen. A rightward shift in that country and beyond may weaken the case for more. Diminished prospects for similar programs would imply a higher structural risk premium on the bonds of Europe's high-debt countries.

- Risk to defense stocks. While member states are primarily responsible for defense spending, the EU has also raised the idea of a100-billion-euro defense fund. Any far-right opposition to further fiscal integration could defeat those hopes.

- Potential positive for energy stocks. The shift to the right is unlikely to undo existing climate policies but could make for a slower green transition by making it harder to pass new laws and adding loopholes to weaken laws that are due to be reviewed.

- Potential positive for small caps. Smaller companies may benefit from populist measures including tax cuts and pension increases for local consumers.

It's not just France. We've seen a shift to populism in other elections this year including Mexico and India and there is the potential for a similar shift in elections scheduled later in 2024. What we may be seeing is a worldwide shift away from traditional centrist politics in developed markets and the rise of populist leaders that were more typical of emerging markets. That can mean the potential for policies that slow exports and raise inflation, lifting market volatility as these risks become an increasing focus of market participants.

Michelle Gibley, CFA®, Director of International Research, and Heather O'Leary, Senior Global Investment Research Analyst, contributed to this report.