Asset Management

Navigating headwinds in the U.S. banking sector

Key takeaways

We believe that U.S. banks have strengthened their balance sheets and improved risk management since the Global Financial Crisis, enhancing their ability to withstand any potential shifts in current economic conditions.

In our opinion, proposed new regulatory requirements—particularly “Basel III Endgame”—should have a credit neutral to slightly positive effect on the banking industry.

Banks have been tightening their lending requirements, given the fluctuating levels of uncertainty regarding the economic outlook.

Commercial real estate and increasing credit card balances are growing concerns for the U.S. banking sector, though we believe that any losses should be manageable in an otherwise benign credit environment.

This complex, dynamic backdrop illustrates why we maintain rigorous credit selection processes and proactive surveillance systems across our Wasmer Schroeder™ Strategies.

Executive overview

The Global Financial Crisis, the COVID-19 pandemic, the 2023 regional bank failures, commercial real estate issues, and potential asset quality deterioration in consumer lending have highlighted the importance of having a resilient banking system. This article examines the U.S. banking industry and its capacity to withstand potential idiosyncratic shocks, an expected slowdown in U.S. economic growth as a consequence of the Federal Reserve’s series of interest rate hikes, regulatory changes, and asset quality concerns.

Bank capital ratios are up and net loans and leases in relation to core deposits have improved

Regulators and banks took steps to improve stability after the Global Financial Crisis. “Basel III”—a new internationally agreed set of capital regulations—was introduced by the Basel Committee on Banking Supervision with the intention of increasing both the quantity and quality of capital for large banks. At the same time, banks strengthened their balance sheets and improved risk management, reducing operational and reputational risk concerns. As a result, banks must meet increased liquidity requirements and retain larger amounts of better-quality capital.

Exhibit 1: Capital ratios for U.S. bank balance sheets are up

Source: Federal Deposit Insurance Corporation (FDIC). For more information, see: https://www.fdic.gov/.

Exhibit 2: Net loans and leases to core deposit ratios for U.S. banks have improved

Source: FDIC. For more information, see: https://www.fdic.gov/.

Loan-to-deposit ratios for the larger banks are well below pre-Global Financial Crisis levels, as noted above. The loan-to-deposit ratio is one measure of a bank’s balance sheet risk, with a higher ratio indicating the bank may be taking on more risk because it has lower cash reserves to cover losses. Banks with a higher ratio may have to rely on wholesale funding to fund lending, which could increase risk in an economic slowdown.

The bottom line: We believe that large U.S. banks are well positioned to withstand idiosyncratic risks in the current economic environment.

Proposed regulation focuses on capital requirements

As we move into 2024, regulation is a major topic for the banks. A number of proposals are expected to be finalized, with a wide range of implications. In addition, if economic growth slows amid the elevated interest rate environment as has been widely expected and the Federal Reserve switches from tight monetary policies to potentially easing interest rates, we believe that analysts’ and investors’ relative areas of focus will shift from deposit and capital considerations to credit quality and revenue streams.

In July of 2023, regulators published the long-awaited capital rules known as “Basel III Endgame.” If finalized, Basel III Endgame would require the most extensive and significant changes to the U.S. capital rules since the implementation of Basel III in 2013. Basel III Endgame substantially revises the capital requirements for banks with total assets of $100 billion ($100B) or more (category I–IV banks), with the largest increase required for the U.S. Global Systematically Important Banks (G-SIBs).

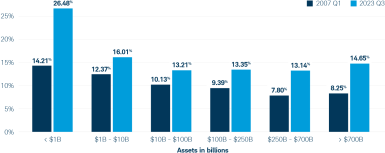

Exhibit 3: Basel III Endgame to raise CET1 requirements

* The Financial Stability Board. As of November 2023, U.S. G-SIBs included: Bank of America Corporation; The Bank of New York Mellon Corporation; Citigroup, N.A.; Goldman Sachs Bank USA; JP Morgan Chase; Morgan Stanley; State Street Corporation; and, Wells Fargo & Company. For more information, see: https://www.fsb.org/2023/11/2023-list-of-global-systemically-important-banks-g-sibs/.

Source: The Federal Reserve. For more information, see: https://www.federalreserve.gov/.

According to regulatory agencies, the Basel III Endgame proposal would result in an estimated 16% increase in common equity tier 1 (CET1) requirement for Category I to IV banks, as defined in Exhibit 3. This estimate is an average based on past data and the impact on each bank will be different. The proposal’s higher capital requirements aim to push larger banks to manage their capital more effectively, which most have already shifted toward in anticipation of the reforms. In addition, Category III and IV banks will no longer be able to option out of recognizing most elements of additional other comprehensive income (AOCI), which includes unrealized gains and losses from available-for-sale securities. With the sharp increase in rates since the end of 2021, many banks have accumulated relatively large unrealized losses in their available-for-sale securities portfolios. Due to this, several banks would have significantly lower capital ratios if AOCI was included. Given that the new regulations are expected to be phased in over a three-year period and losses on available-for-sale securities seem likely to decline materially by 2028 as securities mature, banks should be able to meet their minimum capital requirements, inclusive of AOCI. We therefore expect that the credit impact of the proposed new regulatory requirements will be neutral to slightly positive, although some of the changes will likely affect how balance sheets are managed, which in turn could introduce a degree of uncertainty.

The bottom line: In our opinion, proposed new regulatory requirements, particularly Basel III Endgame, should have a credit neutral to slightly positive effect on the U.S. banking industry.

Regional bank failures of 2023 were not due to insufficient capital

Based on subsequent review by entities including the Federal Deposit Insurance Corporation and Board of Governors of the Federal Reserve System, the failures of Silicon Valley Bank, First Republic Bank, and Signature Bank in early 2023 were generally considered to reflect a combination poor risk management and a quickly shifting interest rate environment, which resulted in risky funding structures and large unrealized losses. Due to the ease with which deposit withdrawals can now be made through internet banking and the rapid dissemination of information via social media, deposit runs on the banks happened quickly, fueling their failures. Despite these results, new liquidity regulations are not part of the proposed regulatory changes, though enhancements and/or new liquidity requirements seem likely. Recently, the director of the Office of the Comptroller of the Currency (OCC) recommended a 5-day liquidity coverage ratio (LCR) to supplement the existing 30-day Basel III LCR requirement.

The bottom line: The high-profile U.S. bank failures in 2023 were primarily fueled by poor risk management and the quickly shifting interest rate environment, rather than by systemic issues.

Bank senior loan officers tightened lending standards

The October 2023 Senior Loan Officer Opinion Survey1 (SLOOS)—which assesses changes in the standards and terms of, and demand for, bank loans to businesses and households over the prior three months—revealed tighter lending standards. For the third consecutive quarter, banks tightened lending standards across all loan categories reviewed by the Federal Reserve. In addition, banks reported weaker demand for commercial & industrial, commercial real estate, residential, auto, and other consumer loans. Regarding commercial real estate, a net 68.3% of respondents noted that they had tightened credit standards for non-farm, non-residential properties, which includes office commercial real estate. This is the second-highest tightening score in the SLOOS data, just under the peak during the COVID-19 pandemic.

Exhibit 4: Bank lending standards tightened in 2023

Source: The Federal Reserve. For more information, see: https://www.federalreserve.gov/.

The most common justification given by banks for tightening lending requirements included a less favorable or more uncertain economic outlook, decrease in risk tolerance, decline in the credit quality of loans and collateral values, and funding cost concerns. In the past, tighter lending standards resulted in higher loan losses in that category, while lower demand resulted in softer loan growth.

The bottom line: U.S. banks have tightened their lending standards amid the more uncertain economic outlook.

Credit performance expected to deteriorate

Credit performance should deteriorate, although not significantly, while commercial real estate and consumer exposure pose growing concerns. As previously stated, most U.S. banks are approaching the shifting environment with materially higher levels of capital and reserves than prior to the Global Financial Crisis. Given these considerations, most banks appear to have entered the current environment with a higher potential capacity to absorb losses.

Exhibit 5: Loss allowances relative to total loan portfolios

Source: FDIC. For more information, see: https://www.fdic.gov/.

The bottom line: Credit performance may deteriorate, although in our opinion, larger banks have the capacity to manage potential losses.

Commercial real estate exposure remains manageable

Although larger banks will likely realize losses due to commercial real estate exposures, we believe that these should be manageable in an otherwise benign credit environment. However, smaller banks, with a greater concentration of commercial real estate, could see additional pressure and a loss in confidence.

Banks are mainly exposed to commercial real estate by:

- Holding nearly half of the approximately $5.8 trillion in outstanding commercial real estate and multifamily debt.2

- Having roughly $380 billion in commercial mortgage back securities (CMBS) on their balance sheets, though Fannie Mae and Freddie Mac securities account for 84% of this exposure, limiting the credit risk.

- Having indirect exposure to commercial real estate through lending to nonbank financial institutions.

Exhibit 6: Commercial bank total loans

Source: FDIC, data as of Q3 2023. For more information, see: https://www.fdic.gov/.

Commercial real estate concerns center on office space

The focus on commercial real estate primarily centers on office space, which accounted for approximately $750B of total commercial real estate and approximately $330B of bank commercial real estate. While commercial real estate loans accounted for approximately 24% of total bank loans, as shown in Exhibit 6, office commercial real estate accounted for less than 3%. The focus on office primarily reflects structural changes due to increased hybrid workforce models adopted by many employers amid the COVID-19 pandemic. The “higher-for-longer” interest rate environment has placed additional pressure on borrowers’ ability to refinance loans while valuations deteriorate. As noted by the Mortgage Bankers Association, property sales and mortgage origination volumes were each down over 50% through the first three quarters of 2023 compared to the same period in 2022. As of the fourth quarter of 2023, Moody’s Analytics put the national office vacancy rate at 19.6%, exceeding the previous high of 19.3% in 1991 during the Savings and Loan Crisis.

Community banks more exposed than large banks

U.S. banks with over $100 billion in total assets—the Federal Reserve’s threshold to be considered a large bank—hold almost 34% of the approximately $2.9 trillion in commercial real estate loans held within the U.S. banking industry. These loans represent a significantly lower concentration in terms of total loans when compared to community banks, which have less than $10 billion in total assets.

Exhibit 7: Commercial real estate exposure vs. total loans

Source: FDIC. For more information, see: https://www.fdic.gov/.

Commercial real estate loans account for a much larger percentage of all loans at community banks. Therefore, these smaller banks would likely have a more challenging time absorbing potential losses as commercial real estate exposure may represent well over 250% of their equity capital.

Exhibit 8: Commercial real estate exposure vs. equity capital

Source: FDIC. For more information, see: https://www.fdic.gov/.

The bottom line: Community banks are much more exposed to potential commercial real estate losses than large U.S. banks, based on equity capital holdings.

Potential loan losses for banks

At the same time, total non-accrual commercial real estate and delinquencies greater than 90 days are higher for larger banks compared to the smaller regional and community banks. This is primarily due to the higher number of non-owner-occupied commercial real estate loans at larger banks, which have generally underperformed amid the hybrid workforce models adopted during the COVID-19 pandemic. Smaller banks tend to have a higher percentage of owner-occupied commercial real estate loans on their books and a deeper relationship with borrowers, where the business is often the primary source of repayment.

Exhibit 9: Past-due loans for commercial real estate in perspective

Source: FDIC. For more information, see: https://www.fdic.gov/.

The leverage and property type underlying commercial real estate loans are likely to play critical roles in their valuations. Owners of buildings with substantial equity cushions are less likely to default, as loans with high loan-to-value ratios are typically harder to refinance or modify. Most commercial real estate property values increased in the years leading up to the pandemic, resulting in lower loan-to-values for many mortgages, providing a cushion. Also, differences in mortgages by property type, deal vintage, term, market, and many other factors will affect performance. Moody’s Analytics noted that as of December 1, 2023, the total number of office loans maturing in the subsequent 12 months was just over $15B, of which approximately $12B, or 80%, have current performance characteristics that would make them difficult to refinance. On a positive note, consumer confidence was robust heading into 2024, inflation has generally been heading in the right direction, and interest rate cuts may finally be on the horizon, all of which is welcomed news for commercial real estate and credit in general.

Commercial real estate loan losses will likely be a challenge for banks, though we believe the losses are unlikely to destabilize the broader financial system since banks have been relatively proactive and generally appear to have sufficient capital reserves to weather any related issues. However, commercial real estate loan losses could be problematic for some smaller community banks, potentially leading to more bank failures, illustrating the need for careful due diligence, and underscoring why thoughtful credit research is such an important ingredient for the success of our Wasmer Schroeder Strategies.

The bottom line: We believe that any losses on commercial real estate loans will likely affect community banks more than regional or large banks but seem unlikely to destabilize the broader financial system.

Credit card losses are expected to peak in 2024

Revolving debt continues to grow and growth in credit card lending continues to outpace commercial and other consumer lending. Both credit card limits and credit card balances have resumed growth trajectories following slight downturns during the COVID-19 pandemic. The increase in credit card debt likely reflects an increase in spending, a lower savings rate, and the loosening of lending standards prior to the Federal Reserve’s recent monetary tightening cycle. Credit line utilization—credit card balance divided by credit card limit—has moved higher but remains below pre-pandemic levels. An increase in utilization could potentially reflect cardholders need to draw on their available credit lines and might be an early warning sign of a deterioration in credit performance.

According to the SLOOS, banks reported loosening lending standards in the fourth quarter of 2020 through the first quarter of 2022 and reported tightening lending standards in third quarter of 2022 through the third quarter of 2023. This included most terms on credit card loans.

Exhibit 10: Revolving debt trends in credit limits and balances

Source: Federal Reserve Bank of New York, Consumer Credit Panel. For more information, see: https://www.newyorkfed.org/microeconomics/faq.

Banks and other credit card lenders pointed to a normalization in credit performance across most loan portfolios as of late 2023 and expect losses to peak in 2024. Credit card delinquencies increased during the four quarters ended September 30, 2023. According to Federal Reserve data, 9.43% of credit card balances were 90+ days delinquent in the third quarter 2023. These levels were higher than prior to the pandemic, but lower than historical highs experienced in 2011. Delinquencies and losses have increased faster among portfolios with lower credit quality.

Exhibit 11: 90-plus day delinquencies by loan type

Source: Federal Reserve Bank of New York, Consumer Credit Panel. For more information, see: https://www.newyorkfed.org/microeconomics/faq.

U.S. banking industry considerations for 2024 and beyond

We believe that the U.S. banking industry is relatively well positioned to withstand potential idiosyncratic shocks that may emerge as the U.S. economy transitions from the current backdrop of a restrictive stance on monetary policy to a more accommodative one. Banking industry positioning is particularly improved versus conditions prior to the Global Financial Crisis. Materially higher capital reserve levels and any potential benefits associated with Basel III Endgame requirements should provide support for the broader U.S. banking industry moving forward as it begins to navigate an economy transitioning toward expected slower economic growth.

However, some uncertainty remains. Asset-quality pressure points have emerged for smaller U.S. banks—particularly for regional and community banks—with commercial real estate a growing concern that may fuel losses in an otherwise largely benign credit environment. Peak credit card losses are anticipated in 2024, with banks and other lenders reporting normalization in credit performance across most loan portfolios as of the end of the third quarter of 2023.

With these collective points in mind, we plan to continue maintaining rigorous credit selection processes and proactive surveillance systems to better ensure that any credit-related shifts within the U.S. banking industry are addressed for potential impact within our Wasmer Schroeder Strategies, supporting the potential for better long-term investment outcomes for our clients.

About the authors

Thomas Werbinski

Lise-Lotte Smith

What to read next

The great interest rate reset: What’s next?

How will fixed income react to slower growth and an easing Fed? Where do we see value today and into 2024? What should you be asking your bond manager? Two Schwab Asset Management® experts supporting our Wasmer Schroeder™ Strategies share their perspectives on the volatile rate environment and the impact on fixed income.