Asset Management

Bank of Japan: End of an Era?

With all the attention on the U.S. Federal Reserve, it can be easy for U.S. investors to forget about the impact of other monetary authorities. For over a decade, the Bank of Japan's (BOJ) policy has enabled Japan to be an important source of investment funding, with negative interest rates allowing investors to borrow cheaply in yen and then purchase investments in other countries offering a higher return. That may be about to end and trigger a reversal in capital flows and a surge in cross-market volatility. Policy changes at the BOJ signaled last week have the potential for major impacts on global financial flows and markets in the coming year.

End of an era?

The BOJ is the only major central bank that has not yet hiked interest rates during the current cycle—but last week the central bank took steps in preparation for a policy change. Like other central banks, the BOJ had pursued QE, or quantitative easing, eventually buying more than 50% of all Japanese government bonds. But it didn't stop there. The BOJ also purchased corporate bonds, commercial paper, equity index exchange traded funds (ETFs) and Japanese real estate investment trusts (J-REITs). No other central bank had been nearly as aggressive or devoted to pursuing QE and negative interest rates. Then, last week, the BOJ officially ended its commitment to buy an unlimited amount of Japanese government bonds in an effort to cap the 10-year yield at 1%, a policy referred to as Yield Curve Control (YCC), signaling a likely shift toward ending QE and hiking interest rates in 2024.

Japan yield curve control range and yen and the 10 year yield

Source: Charles Schwab, Macrobond, data as of 11/5/2023.

The BOJ finally tightening may lead to moves in financial markets around the world, including:

- Upward pressure on bond yields in other developed countries, including the United States.

- An increase in the value of the yen supported by rising short-term rate expectations in Japan compared with the United States and other major countries.

- Gains in Japanese stocks as capital returns to Japan.

Why now?

Inflation in Japan has exceeded the BOJ's 2% target for the past 18 months. This is the longest stretch in decades and the only period of more than a few months that has not been driven by either a domestic tax increase or a sudden currency devaluation.

Japan's inflation and target

Source: Charles Schwab, Japanese Ministry of Internal Affairs and Communications, Macrobond, data as of 11/3/2023.

Last week's big upward revisions to inflation forecasts by the BOJ for this year and next year show the central bank currently anticipates three straight years of inflation exceeding their 2% inflation target. In support of this view, the October release of the Tokyo Consumer Price Index (CPI), a leading indicator of Japan's overall inflation, came in hotter than expected, rising from 2.8% from a year ago in September to 3.8% in October. Core inflation (inflation excluding fresh food and energy) is running at a 42 year high of 4.2% and shows no signs of receding. The time for a change appears to have arrived in Japan after decades characterized by prices more often falling than rising.

Japan seems to be pursuing contradicting goals: the BOJ is buying bonds in an effort to contain bond yields, which makes the yen less attractive, while the Ministry of Finance is at times buying yen to keep the currency from weakening too rapidly. These conflicting policies seem costly and unsustainable. We believe at some point next year the BOJ may need to allow higher bond yields and raise policy rates.

Market response

Unsurprisingly, in response to the BOJ's announcement lifting of their commitment to keep bond yields below 1%, the 10-year Japanese government bond yield rose to 0.94% from 0.89% that day. But, in a seemingly contrary move, the yen briefly weakened by 2% against the U.S. dollar (as the yen per dollar exchange rate rose to 151.7 from 149.1).

The fact that currencies tend to move on differences in inflation-adjusted, or real yields, not nominal yields seems to be the logical reason for this move in exchange rates. Since the BOJ raised its inflation outlook at the same time it ended its unlimited purchases, inflation pressures weighed on both the real yield and the yen.

What's next?

Should U.S. real yields rise at a faster pace than Japanese yields in the near-term, as they have been doing lately, we might expect the yen to remain weak. But the potential for higher real Japanese yields and lower U.S. real yields beyond 2023 could be positives for the Japanese currency.

The rise in real yields in the U.S. has outpaced Japan in recent months

Source: Charles Schwab, Bloomberg data as of 11/5/2023.

Real yields = 10 year yield less core CPI. Past performance in no guarantee of future results.

We expect BOJ policy may unfold with a gradual and managed rise in interest rates in Japan, unlikely to prompt destabilizing capital flows or a big surge in the yen, as we saw in the initial reaction to last week's announcement. However, should economic data prompt the BOJ to significantly tighten policy next year, the cross-market moves could be sizable. Looking back a year ago, we saw significant moves when the BOJ merely shifted the YCC target range for the 10-year yield from 0.25% to 0.50% in late 2022. The yen strengthened sharply (by 15%) as the yen/dollar exchange rate moved from 150 to 127.

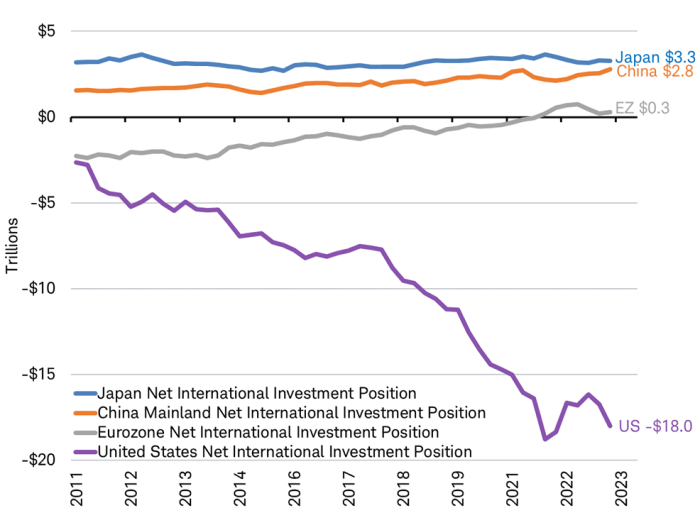

If changes in BOJ policy lead to higher real yields and yen appreciation, Japan's net capital outflows could turn into sizeable inflows. For decades, Japanese institutional and individual investors have borrowed at low rates in Japan to invest at higher rates elsewhere, in what is called the yen carry trade. In addition, Japanese investors are the biggest non-U.S. investors in U.S. Treasuries and among the top five in ownership of non-Japanese stocks. Decades of current account surpluses have accumulated, giving Japan the world's largest net international investment position (even more than China) with $3.3 trillion of investments held abroad according to the International Monetary Fund (IMF). Although the U.S. has the largest economic influence in the world, Japan may have the largest influence in the asset markets due to these account surpluses. Should the BOJ begin to substantially tighten monetary policy, the potential for a reversal of decades of outward flow of capital may be felt by investors worldwide.

Net international investment position by country

Source: Charles Schwab, International Monetary Fund, Bloomberg data as of 11/5/2023.

The impact to investment markets so far has been muted because the difference between Japanese yields and the rest of the world remains large. U.S. yields have risen more rapidly than those in Japan in 2023. Since Japanese yields have not yet been high enough to attract investors, Japanese investors have continued to buy non-Japanese assets. That trend may change with BOJ monetary tightening, particularly if it comes at the same time that the Fed and other central banks begin to cut rates, which would narrow the difference in yields, strengthen the yen and attract Japanese investors to domestic assets.

- Yen - The market may anticipate a higher BOJ policy rate next year while the U.S. Fed is anticipated to cut rates, leading to a narrowing of the spread in short term rates which would favor the yen. The reversal of hedging costs in US dollars, euros, Australia dollars and other currencies could fuel a sharp reversal in exchange rates with the Japanese yen.

- Bonds - Japan holds over $1.1 trillion of U.S. Treasuries, as well as U.S. corporate debt, and large amounts of European, U.K. and Australian government and corporate debt. Any tightening of BOJ policy may put upward pressure on global bond yields to be balanced against other influences.

- Stocks – We wrote this past summer about how Japan's stock market has been strong and off the radar screens of many investors (Japan: Reclaiming Lost Decades). Japan's Nikkei 225 Index has strongly outpaced the U.S.'s S&P 500 so far this year with a gain of 22.4% in yen. Due to the yen weakness, the return measured in U.S. dollars is a mere 7.5%. Stabilization or strength in the yen could make Japanese stocks even more attractive to foreign investors. Domestically, households and most of corporate Japan are underweight domestic stocks relative to historical levels and may reallocate repatriated capital into Japanese equities.

We expect the BOJ to begin to tighten policy next year. The interest rate futures market is pricing in the first 25bps rate hike by the July 31 meeting, but the market and pace of inflation could prompt swifter action. The currency, bond and stocks markets may begin to anticipate what may seem like an increasingly inevitable move and start to price in the potential impacts. With smaller moves towards unwinding QE, the BOJ has tended to surprise markets causing market volatility across asset classes and countries. A bigger unwind in the Bank of Japan's policy may have a bigger impact.

Michelle Gibley, CFA®, Director of International Research, and Heather O'Leary, Senior Global Investment Research Analyst, contributed to this report.