Schwab Target Funds

Summary

The Schwab Target Funds are all-in-one diversified mutual funds, managed according to a projected retirement date. Portfolio managers rebalance the funds to make them more conservative over time.

Objective

The funds seek to provide capital appreciation and income consistent with their current asset allocation.

Highlights

- Reallocated annually to become more conservative over time to help meet investors’ retirement goals

- Competitively priced so your investment goes further

- Combines active and passive proprietary and sub-advised / externally managed strategies*

What is a target date fund?

A target date fund seeks to provide a convenient, all-in-one portfolio solution with a diverse asset mix across equity, fixed income, and cash equivalents allocations that progressively becomes more conservative as the target date—usually retirement—approaches.

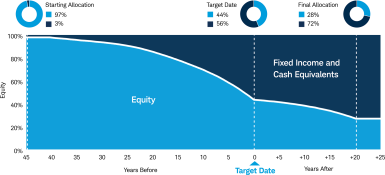

Glide path

The target date is the date when investors are expected to begin gradual withdrawal of fund assets. With the goal of becoming more conservative over time, each fund is reallocated annually to reduce equity and increase fixed income and cash equivalents allocations. The starting allocation of 97% equity and 3% fixed income and cash equivalents changes over time until it reaches 44% equity and 56% fixed income and cash equivalents at the target retirement date. At this time, each fund will continue to reduce its allocation to equity investments for an additional 20 years, reaching its most conservative policy allocation of 28% equity and 72% fixed income and cash equivalents. At this point, the allocation is intended to remain static. At the target retirement date, it is assumed that investors will no longer contribute assets to the fund and, dependent upon each individual’s financial circumstances, will begin to gradually withdraw assets invested in the fund over time.

Selecting a fund

In addition to age and anticipated retirement date, investors should consider their risk tolerance, personal circumstances and complete financial situation and any other investment options prior to investing in a particular target date fund.

Consider investing in the fund closest to your target retirement date, and ensure that the asset allocation matches your risk tolerance, personal circumstances, and complete financial situation. It’s always important to remain aware of your allocation and check in regularly so that you can make updates as your circumstances change.

Underlying Fund Managers or Sub-Advisors

- Allspring Funds Management, LLC

- American Century Investment Management, Inc.

- Baillie Gifford Overseas Limited

- Baird Advisors

- Columbia Management Investment Advisers, LLC

- Dodge & Cox

- Driehaus Capital Management, LLC

- Goldman Sachs Asset Management, L.P.

- Harris Associates L.P.

- JP Morgan Investment Management Inc.

- Loomis, Sayles & Company, L.P.

- Pacific Investment Management Company, LLC

- PGIM Investments, LLC / Jennison Associates, LLC

- Schwab Asset Management

The Schwab Target Funds invest in certain Schwab Funds to gain exposure to underlying third-party sub-advised strategies.

Fund details:

Select a fund from the options below to see further details.