Active products and solutions

Actively managed equity and fixed income mutual funds, ETFs, and separately managed accounts offer core or complementary solutions for an investor's portfolio.

Our approach

We believe in providing a range of active management strategies that address the nuances across equity and fixed income to help investors achieve their objectives. With an active, high-conviction investing strategy, we can use differentiated and rigorous data-driven research to identify investment opportunities.

What we offer

We provide active equity and fixed income mutual funds, ETFs, and separately managed accounts managed by Schwab Asset Management that can serve as core or complementary components of investor portfolios. Additionally, we offer investors access to a select group of active managers through our sub-advised funds.

Active equity strategies

We offer a range of actively managed equity strategies for an investor’s portfolio. Our options include different styles, market caps, and geographies.

Schwab Active Equity Funds

Our suite of actively managed equity funds offer:

- A disciplined investment process that integrates quantitative and qualitative research and analysis through a bottom-up approach to stock selection

- A focus on generating risk-adjusted excess return in order to provide shareholders with long-term value

Learn more about Schwab Active Equity Funds >

In addition to the Schwab Active Equity Funds, we offer sub-advised funds that utilize expertise from third party investment managers and benefit from Schwab Asset Management’s ongoing oversight.

ThomasPartners® Strategies Separately Managed Accounts

ThomasPartners Strategies offers income-oriented strategies to help investors meet their needs today and in the future.

- Designed for monthly retirement income that is less influenced by near-term stock price volatility

- Seek to provide annual dividend growth to help offset inflation over time

- Focus on retirement income generation to reduce an investor's need to distribute principal

- Work to reduce account volatility without sacrificing return potential

Active fixed income strategies

We offer a range of actively managed fixed income strategies for an investor’s portfolio, including mutual funds, ETFs, and separately managed accounts. Our strategies include taxable and tax-exempt options, and they span the duration, credit, and liquidity spectrums.

Schwab Fixed Income Mutual Funds and ETFs

Actively managed led by experienced portfolio managers and benefiting from extensive credit research. Includes taxable and tax-exempt options.

Tax-exempt mutual funds

- Learn more about Schwab Tax-Free Bond Fund

- Learn more about Schwab California Tax-Free Bond Fund

- Learn more about Schwab Opportunistic Municipal Bond Fund

Taxable ETFs

Wasmer Schroeder® Strategies separately managed accounts

Wasmer Schroeder Strategies offer a range of fixed income separately managed accounts across the duration, credit, and liquidity spectrums. These strategies consist of actively managed taxable and tax-exempt options.

Advisor resources

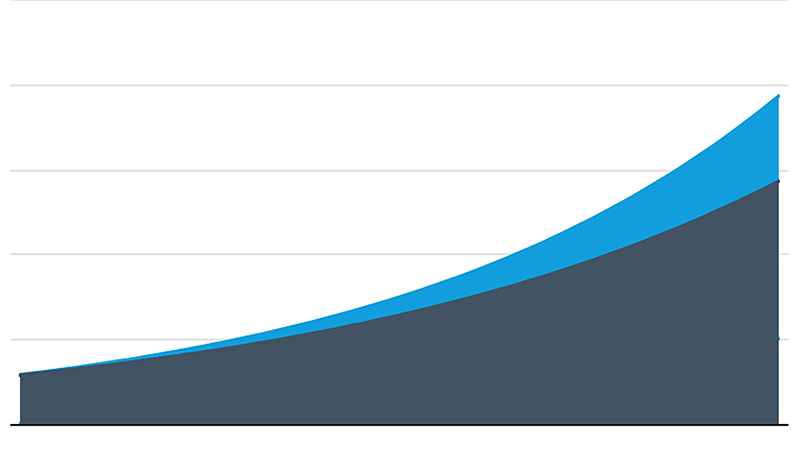

For illustrative purposes only. These projections assume a 5% rate of return, are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Fees will impact your portfolio even during periods of negative market performance. The chart does not reflect all fees that may be charged and is not representative of any actual investment, product, or fee structure. The projections do not reflect the reinvestment of interest and dividends or impact of capital gains or taxes.