Chart in a Minute

Use these market charts to support your conversations with clients about asset-allocation opportunities.

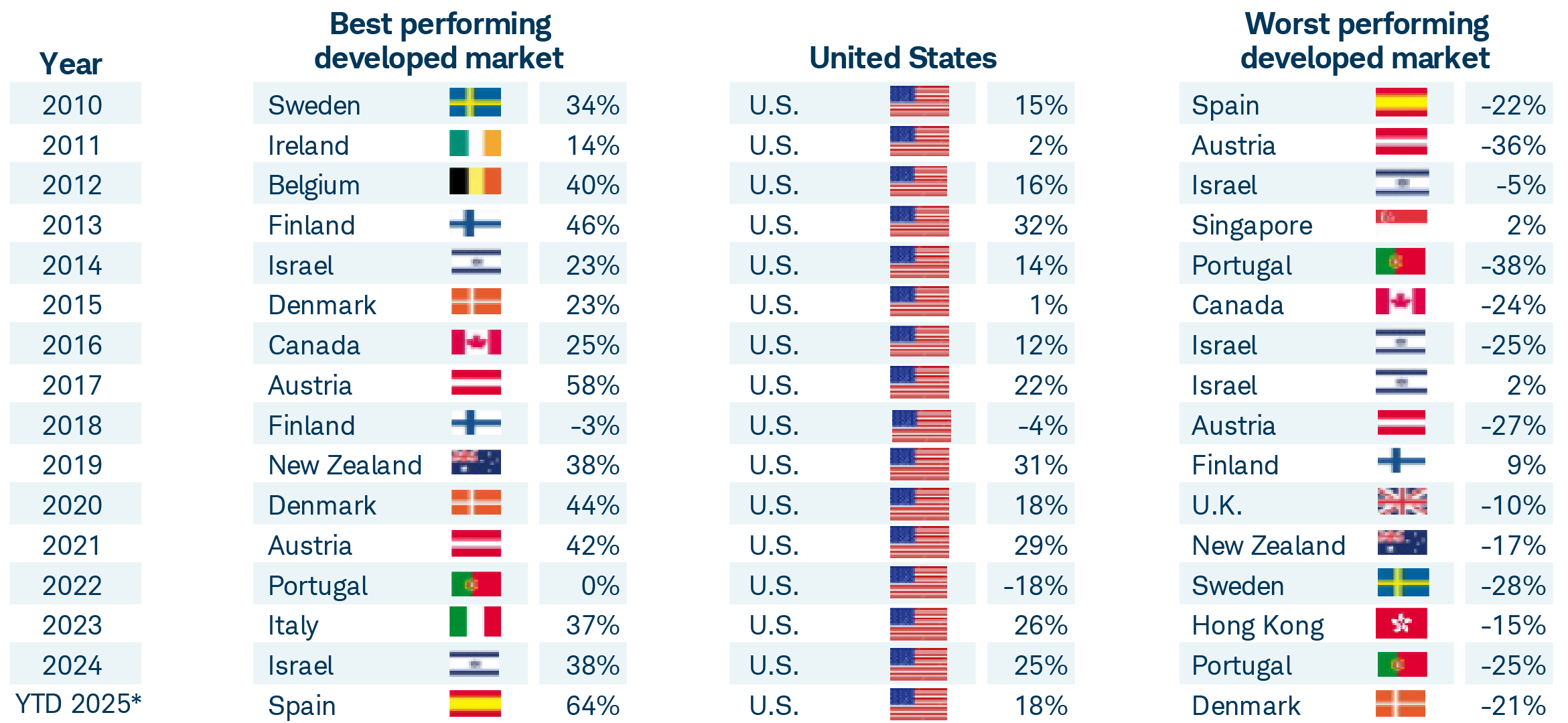

International equities offer potential opportunities for 2026

December 19, 2025

Contrary to what some of your clients might expect, the U.S. hasn’t been the best performing developed stock market since before 2010.

Key takeaways:

- The S&P 500® index returned 25% or more in 2021, 2023, and 2024, and has returned more than 15% YTD through the end of October. So, it’s understandable if your clients have been primarily focused on the U.S. stock market.

- Yet as this table illustrates, the best performing developed stock market for each of the past 15 years hasn’t been the U.S. Instead, a developed international stock market has consistently earned that prize year after year.

- With the U.S. economy lukewarm, the labor market cool, consumer sentiment weak, and the Federal Reserve divided over the outlook for interest rates, international stocks might be worth talking with your clients about when exploring opportunities for 2026.