Serious Business: Assessing Earnings Season

We're in the midst of reporting season for third-quarter earnings as the market faces its largest decline this year. With the S&P 500®, Nasdaq, and Russell 2000 all mired in correction territory (down by 10% or more from their peaks this summer), earnings season could hold a key to whether the market continues lower or is able to stabilize. Earnings season is at halftime, so let's assess how the season is shaping up thus far and whether it looks like the earnings recession is over.

As shown in the table below, the blended growth rate (which combines already-reported results and estimates for those to come) for third-quarter S&P 500 earnings has risen to 4.3% per LSEG (London Stock Exchange Group) I/B/E/S data. At the sector level, the drags are from Materials, Health Care, and Energy, with the latter accounting for a significant chunk of earnings weakness. Excluding the Energy sector, the blended growth rate is near 10%.

Earnings expectations climbing

Source: Charles Schwab, LSEG I/B/E/S, as of 10/27/2023.

Forecasts contained herein are for illustrative purposes only, may be based upon proprietary research and are developed through analysis of historical public data. Past performance is no guarantee of future results.

A 4.3% growth rate is elevated in comparison to expectations over the past few months, as shown in the chart below. That's a very recent phenomenon courtesy of earnings late last week from Amazon, Alphabet, and Intel which boosted growth to a significant degree. Before those three companies reported, the blended growth rate was 2.6%. Interestingly, alongside the pop higher in third-quarter estimates, the opposite was occurring for fourth-quarter estimates, which have fallen to the lowest in a year.

Third quarter giveth; fourth quarter taketh

Source: Charles Schwab, LSEG I/B/E/S, as of 10/27/2023.

Forecasts contained herein are for illustrative purposes only, may be based upon proprietary research and are developed through analysis of historical public data. Past performance is no guarantee of future results.

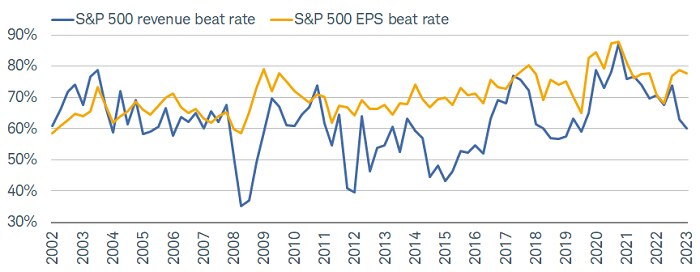

If there is a positive catalyst for the market lurking within earnings data, it might be found in the revenue stats. While several forces have been responsible for stocks' struggle since late July, we think a dominant driver has been the lack of top-line strength. For all the cheering over the rebound in the earnings beat rate (the percentage of companies reporting profits above analysts' estimates) in the second quarter, the revenue beat rate fell to a multi-year low. As shown in the chart below, the gap between the earnings and revenue beat rates has widened even more in the third quarter.

In our view, beat rates are less important than actual growth rates, not least because the post-COVID environment has been tougher for analysts and companies to navigate when it comes to expectations and revisions to estimates. Nonetheless, any divergence in earnings and revenue data is worth paying attention to, especially if a rebound in earnings is almost exclusively due to aggressive cost-cutting—which seems to still be the case recently. We think a stronger rebound in revenues would likely help the market find more support in the near term, but market breadth also needs to improve (more on that later).

Top line vs. bottom line

Source: Charles Schwab, LSEG I/B/E/S, as of 10/27/2023.

Past performance is no guarantee of future results.

A sustained increase in optimism about earnings may not last given earnings revisions recently turned decisively negative. As shown in the chart below, the Citi U.S. Earnings Revisions Index has been down for six consecutive weeks. In bull markets and earnings recoveries that began after the bear markets in 2000-2002 and 2007-2009, earnings revisions were not consistently in negative territory after stocks bottomed. That matters because we just passed the anniversary of the 2022 October low for the S&P 500, and because there is still furious debate as to whether we truly entered a new bull market earlier this summer, when the gain from October 2022 exceeded 20%.

Red revisions

Source: Charles Schwab, Bloomberg, as of 10/20/2023.

The Citi U.S. Earnings Revisions Index is calculated as the ratio of analysts' earnings per share revisions to listed companies tracking equity analyst revisions upgrades (positive) vs. downgrades (negative).

There is waning enthusiasm about the market when looking at investors' reactions to earnings releases. For companies beating estimates, during the first trading day post-release, the average stock gain in excess of the S&P 500's gain is just 0.7%, as shown in the chart below. As is typical, those missing estimates are getting punished a lot more, with their excess return falling to -3.3%.

Misses hammered; beats unimpressive

Source: Charles Schwab, Bloomberg, as of 10/27/2023.

Past performance is no guarantee of future results.

In sum

Estimates for earnings growth are firming as some mega-cap heavyweights do most of the work for the rest of the market. The reality is that there remains a strong bifurcation in the market: excluding the largest names, which are this year's highfliers, earnings growth and year-to-date performance are still down or flat at best. If there is a gem to be found in the current reporting season, it would likely be a stronger rebound in revenue growth, but as of now, that doesn't appear to be the case. Our sense is that the market won't find its way out of this correction until market breadth improves. As of now, that also isn't the case. Consider the following, which are through Friday's (October 27th) close:

- Only 25% of S&P 500 members are trading above their 200-day moving averages (the lowest since October 2022).

- Only 21% of Russell 2000 members are trading above their 200-day moving averages (the lowest since October 2022).

- The S&P 500 Utilities and Real Estate sectors are near their lowest levels in two and three years, respectively.

- The KBW Bank Index has wiped out all gains since October 2020.

As we have mentioned several times this year, it isn't the strong, disproportionate performance of the largest stocks in the market that should be ridiculed; it's the fact that the rest of the market has failed to participate. That takes on an increasing amount of importance now that the one-year mark of a bear-market low has been passed.