What Happened to ESG Stocks?

While Environmental, Social, Governance (ESG) investment screens based on corporate policies means different things to different people, for investors the term is probably most closely associated with "green" or alterative sources of energy to address sustainability and climate concerns.

The lead up to the 2020 U.S. elections saw alternative energy stocks outperform traditional energy stocks by a very wide margin, as you can see in the chart below. Progress on Europe's Green Deal and candidate Biden's emphasis on climate initiatives gave these stocks a big boost, especially relative to traditional energy companies. Over the subsequent three years, the performance gap has been completely erased. What happened?

Alternative energy has given up all its outperformance relative to traditional energy

Source: Charles Schwab, Macrobond data as of 10/19/2023.

Indexes are unmanaged, do not incur management fees, costs, and expenses and cannot be invested in directly. An index number is a figure reflecting price or quantity compared with a base value. The base value always has an index number of 100. The index number is then expressed as 100 times the ratio to the base value in August 2018. Past performance is no guarantee of future results.

Trends in clean energy

What didn't happen was that the trends favoring alternative energy did not fade away. In fact, the broad trends in terms of policy, adoption, and pricing continue.

- According to the International Energy Agency, global investment in clean energy is expected to rise to $1.7 trillion this year, with investments in solar projects eclipsing oil exploration and production.

- The European Green Deal, a package of initiatives to cut greenhouse gas emissions and direct investment toward sustainability was adopted in 2021.

- The U.S. Inflation Reduction Act was passed in 2022, arguably the most significant climate legislation in U.S. history, offering funding, programs, and incentives to accelerate the transition to a clean energy economy. As of July 31, 2023 the U.S. has announced over $270 billion in capital investments, equal to the total investments commissioned between 2015-2022, according to a report by American Clean Power.

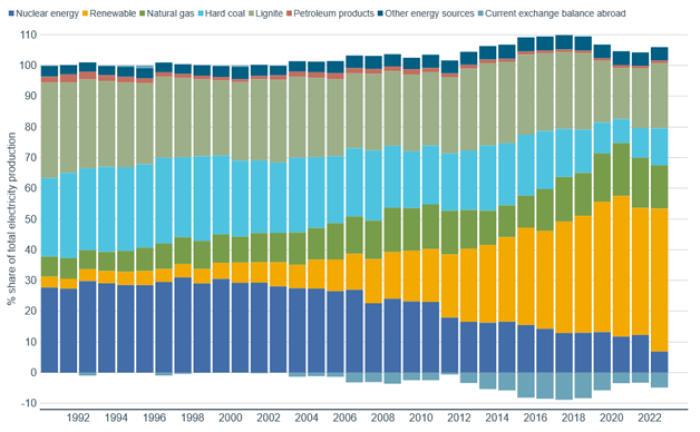

- Following Russia's invasion of Ukraine in 2022, headlines heralded a "return to coal," dirtying up Europe's green energy future. Well, the rise in coal use in 2022 seen in the chart below is turning out to be a blip. In August 2023, year-over-year coal-power generation declined 39%, replaced by wind, solar, and hydroelectric power. Coal fell to its lowest share of power generation since at least 1990, according to data from the Centre for Research on Energy and Clear Air (CREA). More than 50% of power production now comes from renewable sources, more than double that of 10 years ago.

German electricity production by source

Source: Charles Schwab, Macrobond, Arbeitsgemeinschaft Energiebilanzen EV as of 10/1/2023.

- China's massive annual growth in coal-power generation has helped drive the country's soaring carbon output over the past decade. But, in September 2023, hydroelectric power had the second-best year-over-year growth among all major industrial products in China, second only to the 39% growth rate of solar panels, according to industrial output data from the National Bureau of Statistics. It's possible that China may experience its second year in a row of falling carbon emissions and be closer to its pledge of a peak in emissions by 2030 as it incorporates more sources of alternative power.

- Finally, traditional energy prices have remained high around the world, with a further surge this year as the supply of oil from OPEC+ has been cut. The global benchmark for crude oil, Brent, is around $90 per barrel—more than double the price in mid-2020 when the alternative energy stocks began to soar—and remains well above its 10-year average.

Oil prices remain high

Source: Charles Schwab, Bloomberg data as of 10/19/2023.

What happened?

Given all those trends, it would seem that alternative energy stocks should be thriving. Instead, they are among the world's worst performers this year. What changed? Interest rates.

While government mandates are driving investment, private sector demand has slumped on higher borrowing costs for homeowners. On Friday, SolarEdge Technologies, Inc. warned that third-quarter revenue will be well below its guidance, citing "substantial" cancellations and delayed orders. On Wednesday, Tesla, Inc. reported solar deployments dropped for the third consecutive quarter.

Higher interest rates are impacting these companies' finances. The stocks in the MSCI World Alternative Energy Index have a leverage ratio of 3.8, based on debt-to-12-month earnings, compared with just 1.1 for the five biggest energy producers by market capitalization. That means higher financing costs are much more costly for these companies.

Higher interest rates are also pushing down valuations of these stocks. When it comes to determining the price of stock, an often-overriding factor to consider when it comes to investing is the discount rate, the interest rate used in discounted cash flow analysis to assess the present value of future cash flows. The higher the discount rate, the lower the present value of future cash flows—especially cash flows expected in the more distant future. This can drive down the valuation measured by the price-to-earnings and price-to-cash-flow ratios. An example of how this has impacted alternative energy companies can be seen with First Solar, the stock with the largest weighing in the S&P Global Clean Energy Index. The company's earnings per share more than doubled since 2021. Yet, the price-to-earnings ratio plunged from a high of 48.5 in 2021 to now stand at 14.7.

In general, alternative energy companies are what we call "long duration" stocks, meaning they are expected to deliver a higher proportion of their cash flows in the more distant future. As we continue to point out, short duration, or companies with more immediate cashflows, has been the place to be. We wrote about how investors can hedge rising interest rates when the 10-year yield had just ticked over 2.5%. One and a half years later the 10-year yield is over 4.5%. Since then, short duration stocks have provided four times the return of the market.

To measure duration for stocks we use the price-to-cashflow ratio—the lower the ratio, the shorter the duration. While short duration stocks underperformed during the few months of bank stress that began in March, they have returned to outperforming the overall market. We believe stocks with low price-to-cashflow ratios remain attractive in this environment of quantitative tightening and lackluster earnings growth.

Short duration stocks continue to outperform

Source: Charles Schwab, FactSet data as of 10/20/2023.

Past performance is no guarantee of future results. Short duration defined as lowest quintile by price-to-cashflow for stocks in MSCI World Index.

What led many ESG stocks to give up all their relative gains wasn't policy changes, earnings disappointments, or the cost of oil; it was largely the result of rising interest rates. While higher interest rates may maintain the unattractive environment for ESG stock performance in the near term, should interest rates begin to decline it is possible alternative energy stocks could regain their lost luster for investors.

Michelle Gibley, CFA,® Director of International Research, and Heather O'Leary, Senior Global Investment Research Analyst, contributed to this report.