Making International Great Again?

A main driver of the stock markets this year appears to be President Donald Trump's "America First" policies. Yet, it's the international stock markets that are coming in first with the MSCI EAFE Index off to its best start to a year in more than 25 years, even as the U.S.'s S&P 500 has suffered losses this year. Trump's policies seem to be driving pro-growth policy shifts in Europe and Asia.

International stocks have best start to a year in a quarter of a century

Source: Charles Schwab, Bloomberg data as of 3/7/2025.

Indexes are unmanaged, do not incur management fees, costs, and expenses and cannot be invested in directly. For more information on indexes, please see schwab.com/indexdefinitions. Past performance is no guarantee of future results.

Tariff turmoil

The on-again, off-again tariffs with the U.S.'s major trading partners seems to have created an environment of uncertainty in the United States. We noted late last year that President Trump has a history of rapid changes in policy and tariffs could come and go quickly—and that has certainly been the case thus far. The 25% tariffs on imports from Colombia came and went in just nine hours. And, of course, the across-the-board tariffs on imports from Mexico and Canada were delayed from February 3 to March 4, and then given a reprieve just 48 hours days after they went into effect with a further delay until April 2. It is a fluid situation; U.S. tariffs could change again later today, this week, this month or next quarter.

Tariffs: what might be next

Source: Charles Schwab, as of 3/7/2025.

The next date on the tariff watch is March 12 for metals' tariffs. The aluminum tariff could also be delayed in deference to the potential negative impact on U.S. manufacturers. The U.S. currently imports about 50% of its primary aluminum, used to make many things including airplanes and cars, two areas where the U.S. competes on a global stage. So, a desire to make good on his tariff threats may be balanced by Trump's desire to have a legacy of restoring U.S. manufacturing.

The "reciprocal" tariffs set for April 2 is the report day on the matter and may not be the day of implementation. These tariffs are potentially the most complicated, which might be cause for a delay. Instead of three categories for each of 17,000 imported products, there is an estimated 183 different categories (one for each country) for each of those 17,000 products, totaling over 3 million different tariffs. Trump suspended tariffs on shipments worth less than $800 from China, after his sudden order ending duty-free treatment left the U.S. postal service and other agencies scrambling to comply. The president said the delay would remain in place until "adequate systems are in place to fully and expediently process and collect tariff revenue." The systems required for "reciprocal" tariffs, if applied to every import, could be greater by orders of magnitude.

The longer the tariff turmoil and related uncertainty about trade policy lasts, the more likely economic and earnings growth may take a hit. We can see this in the relative performance of the economic surprise indexes this year with U.S. data missing economists' expectations while European economic data is exceeding expectations.

European economic data beating expectations

Source: Charles Schwab, Citigroup, Bloomberg data as of 3/7/2025.

Indexes are unmanaged, do not incur management fees, costs, and expenses and cannot be invested in directly. For more information on indexes, please see schwab.com/indexdefinitions.

Europe's stimulus

With Trump threatening European auto imports with tariffs on April 2, the European Commission proposed easing emissions rules that were supposed to get stricter this year, aiding automakers. Companies in the industrials and materials sectors have a brightening outlook on the prospect Germany may unlock hundreds of billions of euros for defense and infrastructure investments. Many of these actions have been in response to the Trump administration's threats to targeting European auto imports with tariffs and to back away from supporting Europe's defense. German stocks are up over 20% so far this year, measured in U.S. dollars.

The outlook for a further rise in European Union (EU) defense spending got another boost from the Trump-Zelensky meeting that made it clear to Europe that the U.S. was leaving the EU to its own defense. Increasing defense spending seems to be one issue that seems to unify Europeans, with the potential for the exclusion of defense expenditures from EU deficit rules for member countries. Greater EU defense spending seems like more of a sure thing in a world of increasing uncertainty offering investors the prospect for a new Magnificent Seven. There are seven stocks in Europe's Defense index: the MSCI EMU Aerospace and Defense Index and they are up nearly 40% this year through March 6, while the U.S.'s "Magnificent Seven" stocks are down about 10%.

A new Magnificent Seven?

Source: Charles Schwab, MSCI, Bloomberg data as of 3/6/2025.

Indexes are unmanaged, do not incur management fees, costs, and expenses and cannot be invested in directly. For more information on indexes, please see schwab.com/indexdefinitions. Past performance is no guarantee of future results.

China's stimulus

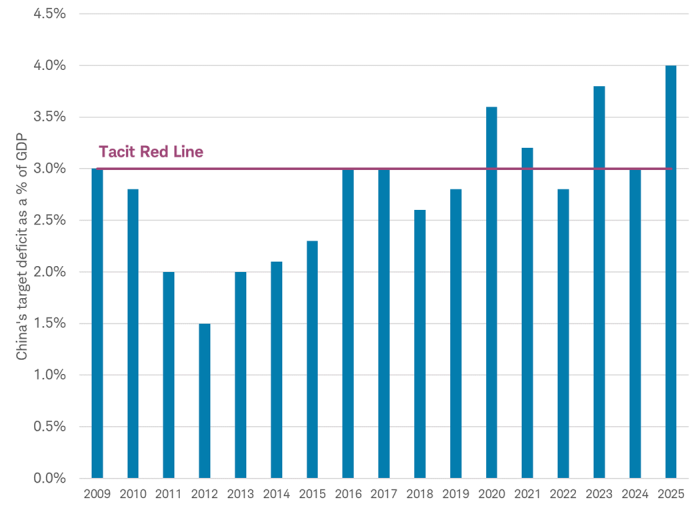

China's March 5 National Peoples' Congress meeting pledged a 5% GDP target (for the third year in a row), an ambitious goal given the challenges posed by Trump's tariffs and technology export restrictions on the country. Growth is to be driven by a sizable boost to the deficit, according to the annual report Premier Li Qiang delivered to the national parliament last week. China set its fiscal deficit target to around 4% of GDP, to counter the effects of U.S. policies. This fiscal deficit target is the highest level in more than three decades (since a major tax overhaul in 1994). For decades, China has tried to keep the official deficit at no more than 3% of GDP to demonstrate fiscal discipline. Crossing that line signals President Xi is willing to take unconventional steps to boost domestic demand as Trump's tariffs and negotiations with other countries threaten China's exports, which made up nearly a third of the economy's growth last year.

China sets official deficit target at highest in decades

Source: Charles Schwab, National Bureau of Statistics, Government Work Report as of 3/7/2025.

China announced modest retaliatory tariffs in response to those from the Trump administration. Rather than engage in an escalating trade war, the work report represents the primary efforts by top Chinese officials since Trump took office to shield the world's second largest economy from the impact of tariffs and investment restrictions.

In addition, after years of an uncertain regulatory environment, there may be a business-friendly shift with a meeting between President Xi and tech leaders in February and supportive language at the policy meeting last week. China is seeking to drive its tech innovation, most recently signaled by the success of the DeepSeek Artificial Intelligence (A.I.) model, in response to tighter export controls of key hardware by the Trump administration. China's stocks are up over 20% this year, measured in U.S. dollars.

Great again

Trump's policies are not the only thing driving international stock markets to post strong outperformance this year. For example, economic and earnings estimates are on the rise in Europe, along with ongoing rate cuts by the European Central Bank—which made its sixth cut this cycle last week—helping to lift price-to-earnings ratios. It has been true in the past that pro-growth policy moves forward one crisis at a time. Investors in international markets may have the Trump administration's global trade war to thank for driving another such response that has delivered great performance for international markets so far this year.

Michelle Gibley, CFA®, Director of International Research, and Heather O'Leary, Senior Global Investment Research Analyst, contributed to this report.