2025 Municipal Bond Outlook

We expect the muni market to be characterized by a tale of two half-years in 2025. Changes to tax policy will likely dominate the first half of the year and then munis should adjust over the second half of the year. We're cautious about longer-term bonds and lower-rated issuers going into 2025. The outcome of the election has raised the probability that inflation and yields move higher. Credit conditions for most issuers are favorable and many issuers are entering 2025 with strong reserves that they can tap into if there's a slowdown in revenues. However, spreads for lower-rated issuers are tight and not attractive in our view.

Yields are currently attractive

We believe municipal bonds currently offer a compelling balance of risk and reward for investors in higher tax brackets and that hasn't changed after the election outcome. Taking a longer-term view, absolute yields remain attractive for higher-net-worth investors. For example, the yield on the Bloomberg Municipal Bond Index, which is a broad index of munis, was 3.4% as of December 3, 2024. That's the equivalent of roughly 7% for a fully taxable bond for an investor in the top federal tax bracket in a high-tax state like New York or California. Municipal bonds generally pay interest income that's exempt from federal and potentially state income taxes (if purchased from your home state). One way to compare the yield on a tax-exempt muni to that of a fully taxable bond is to look at the tax-equivalent yield. That's the hypothetical yield that would make the yield on a fully taxable bond after considering the impact of taxes equal to a tax-exempt muni.

The tax-equivalent yield for an investor in the top tax bracket is near its high over the past 15 years

Source: Bloomberg Municipal Bond Index, as of 12/3/2024.

Assumes a federal tax rate of 35% from 2004 to 2012, 39.6% from 2013 to 2017, and 37% from 2018 to 2024. Also assumes an additional 10% state income tax and 3.8% Net Investment Income (NIIT) tax. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results. For illustrative purposes only.

It's not just absolute yields that are attractive now. When compared to other fixed income asset classes, a similar story holds: Muni yields, especially after considering taxes, are attractive relative to their risks. The chart below plots the yields for various fixed income investments compared to their standard deviation of returns over the past 20 years. For example, the tax-adjusted yield for the broad index of munis has a very similar yield as high-yield corporate bonds. However, the risk is substantially lower. In other words, high-net-worth investors can get yields with munis that are similar to those from high-yield corporate bonds but with much less risk. Being in the upper-left-hand quadrant is the most attractive because it means that yields are high but that the volatility of returns is low. The worst quadrant to be in is the lower right, in that yields are low, but volatility is high.

Yields and standard deviation during the past 20 years

Source: Schwab Center for Financial Research with data from Bloomberg. Yields are as of 12/2/2024.

TEY = tax-equivalent yield. Standard deviation is a measure of how much an asset's return varies from its average return over time. Annualized standard deviation of monthly returns are from 10/29/04 to 11/30/24. Yield to worst is a measure of the lowest possible yield that can be received on a bond that fully operates within the terms of its contract without defaulting. Indexes are unmanaged, do not incur management fees, costs, and expenses and cannot be invested in directly. Indexes represented are: HY corporates = Bloomberg U.S. Corporate High-Yield Bond Index; Preferred securities = ICE BofA Fixed Rate Preferred Securities Index; IG corporates = Bloomberg U.S. Corporate Bond Index; Munis = Bloomberg Municipal Bond Index; U.S. Aggregate = Bloomberg U.S. Aggregate Bond Index; Treasuries = Bloomberg U.S. Treasury Index; Agencies = Bloomberg US Agg Agency Total Return Index; Int. developed (x-USD) = Bloomberg Global Aggregate ex-USD Bond Index; and EM = Bloomberg Emerging Market USD Aggregate Index. Securitized = Bloomberg U.S. Securitized: MBS/ABS/CMBS and Covered Index; TIPS = Bloomberg U.S. Treasury Inflation Protected Securities (TIPS) Index. Past performance is not a guarantee of future results. For illustrative purposes only.

Changes to tax policy are likely to get brought up early next year

The outcome of the election significantly increased the odds that Congress will alter taxes in 2025. It's difficult to handicap how changes to taxes may impact munis because we don't know exactly what will change. On the campaign trail, President-elect Donald Trump proposed extending the expiring 2017 Tax Cuts and Jobs Act (TCJA), bringing back the state and local tax (SALT) deduction, lowering the corporate tax rate, and exempting various types of income, like overtime or tips, from income taxes.

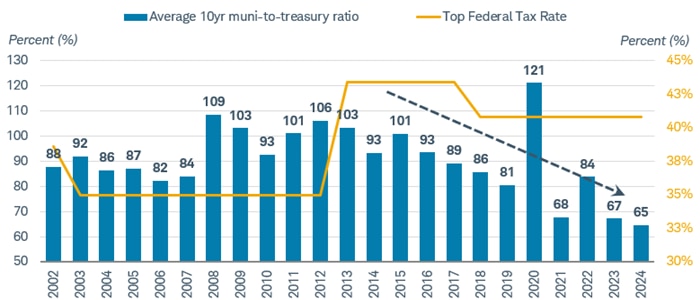

Theoretically, a lower tax rate should result in a higher muni-to-Treasury ratio, but that didn't occur when the 2017 TCJA was originally enacted. In fact, the average annual 10-year muni-to-Treasury ratio has fallen most every year over the past decade. The muni-to-tax ratio, or MOB spread, is a ratio of the yield on a generic AAA rated muni compared to a Treasury before considering taxes.

The average 10-year muni-to-tax ratio has fallen over the past decade regardless of changes to the top federal tax rate

Source: Bloomberg and the Tax Foundation, as of 12/2/24.

RHS = righthand scale. Note that 2024 is year to date. For illustrative purposes only.

It's Congress's job to make tax policy changes. Although the president can propose changes to the tax laws, it's up to Congress to write the law. Given the sweep by Republicans, it's highly likely that the TCJA will be extended in some fashion. Our expectation is that tax policy changes will be an issue that Congress will take up in the first or second quarter of 2025. We anticipate that lawmakers will use the budget reconciliation process to pass changes, which is notable because it only requires a simple majority to pass but gives additional scrutiny to debt and deficits. It's how the TCJA in 2017, the American Rescue Plan Act (ARPA) in 2021, and the Inflation Reduction Act in 2022 were all passed.

The muni market hasn't reacted to the potential for tax law changes. If it were to, you would expect to see the breakeven tax rate between corporates and munis move lower and/or the muni-to-Treasury ratio to move higher, but neither has happened. The "breakeven tax rate" is the all-in tax rate (federal, state, local, and any other applicable taxes) that would make the after-tax yield on an index of corporate bonds equal to the yield on an index of munis. It is 36%, which is about the same as it was at the beginning of June.

The breakeven tax rate hasn't moved much since June

Source: Bloomberg. Daily data as of 12/2/2024.

The Bloomberg U.S. Municipal Index (LM07TR Index) and the Bloomberg US Intermediate Corporate Bond Index (LD06TRUU Index).

What this all means for investors is they shouldn't speculate about how taxes may change and make investment decisions based on that. The devil will be in the details, and we just don't know enough at this point to suggest changes.

Is the muni tax exemption at risk?

We believe there's a low probability that the exemption gets repealed because it would do more harm than good. It would do little in the way of raising revenue to help pay for the TCJA. The U.S. Department of the Treasury releases an annual report about the "cost" of different income tax items. The 18th biggest cost is the municipal bond tax exemption. If all munis were considered taxable, an additional $281 billion of revenue could be generated over the next 10 years, according to Treasury estimates. That's meaningful, but the estimated cost of the TCJA if it gets extended would be nearly $5 trillion.

Eliminating the muni tax exemption would do very little to help pay for the estimated cost of the TCJA

Source: U.S. Department of Treasury, as of FY 2025 and Congressional Budget Office, as of 5/3/2024.

Note: "TCJA" stand for "Tax Cuts and Jobs Act". Forecasts contained herein are for illustrative purposes only, may be based upon proprietary research and are developed through analysis of historical public data.

If the exemption were repealed, interest rates for newly issued munis would very likely increase to account for the loss of tax advantages. This would increase borrowing costs for municipalities and probably curtail infrastructure investments. Additionally, the use of municipal bonds is not a Republican or Democrat issue. They're widely used by governors and municipal officials from both political parties.

What's more likely than a full repeal of the exemption is to trim around the edges and repeal the ability of some issuers to issue tax-exempt debt or cap the amount of tax-exempt interest a filer could claim. In an early version of the 2017 TCJA, legislatures proposed eliminating the ability of some issuers, like airports, private universities, and hospitals, to issue tax-exempt bonds. This never was passed but it wouldn't be a surprise if it were proposed again.

For investors, if this were to occur, and it's a big if, we would expect that existing bonds by these types of issuers would still pay interest income that's tax-exempt. However, their ability to issue new tax-exempt debt would be eliminated.

The backdrop for credit quality remains positive going into 2025

We view the backdrop to credit quality as generally favorable, but more pockets of risk are beginning to emerge. Overall, the economy continues to remain resilient, with gross domestic product hovering in the 3% area, the unemployment rate low relative to history, and home prices having risen dramatically since the onset of COVID-19. This is all supportive of tax revenues for many municipalities.

Additionally, over the past few years many state and local governments have built up their liquidity positions due to strong revenue growth and substantial fiscal aid. Prior to the 2020 COVID crisis, only six states could operate on reserves alone for more than 100 days. As illustrated in the chart below, that has shifted and as of fiscal year 2023, 34 states could operate for more than 100 days using only reserves.

Most states have built up their rainy-day funds over the past few years

Source: Pew Charitable Trusts, as of 9/19/2024.

Waning fiscal aid will be a headwind for some issuers

Although many issuers' liquidity positions are high, fiscal aid is waning and what happens next poses a headwind to some municipalities. The money provided under the ARPA must be designated for what it will be used for by the end of this year and spent by the end of 2026. A credit risk in 2025 and beyond is that some issuers chose to allocate those funds to recurring, rather than one-time, expenses and once the funds run out, they'll have to find additional sources of revenue or cut back on expenses. According to a recent study by the National League of Cities, nearly a third of all cities they polled said that expiring ARPA funds posed between a "somewhat" and "extreme" concern regarding budget shortfalls. In how they planned to address the budget shortfalls, a quarter said they had no strategy in place.

Nearly a third of cities are at least "somewhat" concerned with ARPA funds ending

Source: Omeyr, Farhad, Ph.D., "City Fiscal Conditions 2024," National League of Cities.

Note: Totals may not add up to 100% because respondents were able to select multiple answers.

One of the things that you can usually hang your hat on with munis is "strong credit quality." We expect "strong credit quality" to remain a staple of the muni market, but we're likely past the peak in credit quality and the bad actors will slowly resurface.

Investors should focus on higher-rated issuers in 2025

Higher-rated issuers generally have stronger liquidity positions and/or more stable revenues than lower-rated issuers so they can better manage the potential headwinds. Second, spreads for BBB1 rated muni issuers are very low. A spread is the additional compensation, in the form of yield, for investing in a lower-rated credit. The yield spread between AAA and BBB issuers has declined recently and is near the lowest it has been over the past 15 years. In other words, given tight spreads and the potential for credit headwinds, we think it's appropriate to be cautious right now.

BBB rated munis yield just 0.85% more than AAA rated bonds

Source: Bloomberg, weekly data as of 12/3/2024.

Chart shows the difference in yield to worst between the AAA and BBB components of the Bloomberg Municipal Bond Index. Yield to worst is a measure of the lowest possible yield that can be received on a bond that fully operates within the terms of its contract without defaulting. Average is from 12/30/2009 to 12/3/2024. Difference in yields may be attributable to other factors such as coupons, maturities, durations, or other factors. Indexes are unmanaged, do not incur fees or expenses, and cannot be invested in directly. Past performance is no guarantee of future results.

What should investors consider now?

The possibility of tariffs resulting in a trade war, changes in tax policies, and the proposed immigration policies all raise the possibility that inflation increases and yields move higher. These are just proposed policies and they may have all been campaign talk, but the risk is now tilted toward higher rather than lower yields.

For investors, we suggest a benchmark or below-average duration. For the average muni investor, that's a duration of about six years. It will vary based on a client's risk tolerance and need for their money but that's a good starting point for many investors.

How high yields move up is going to depend on several factors but given the uncertainty of what could occur, we think it's prudent to take a more cautious approach with duration. Credit conditions remain positive for most issuers but we're likely past the peak in credit quality and given tight spreads, we think it's also prudent to be cautious with credit bets. Yields will likely be volatile as the market sifts through the myriad issues the new administration has discussed. The balance of risks is toward higher yields so in the near term, we suggest sticking to a benchmark-or-below duration. Bond ladders continue to be a good option to take the guesswork out of rates.

1 The Moody's investment grade rating scale is Aaa, Aa, A, and Baa, and the sub-investment grade scale is Ba, B, Caa, Ca, and C. Standard and Poor's investment grade rating scale is AAA, AA, A, and BBB and the sub-investment-grade scale is BB, B, CCC, CC, and C. Ratings from AA to CCC may be modified by the addition of a plus (+) or minus (-) sign to show relative standing within the major rating categories. Fitch's investment-grade rating scale is AAA, AA, A, and BBB and the sub-investment-grade scale is BB, B, CCC, CC, and C.