Are Preferred Securities Still Attractive?

Preferred securities offer some of the highest yields in the fixed income universe today. That can be attractive for income-oriented, long-term investors, but the risk of higher long-term Treasury yields means that prices could fall modestly over the short run.

Preferred securities are a type of hybrid investment that shares characteristics of both stocks and bonds. The higher yields they currently offer can be a nice benefit for income-oriented investors, but those higher yields reflect the additional risks they face.

The outlook today is a bit mixed, as there are both benefits and risks to understand when considering preferreds. They can make sense for income-oriented investors, especially those in higher tax brackets, but their relatively slim yield advantage over investment-grade corporate bonds today makes them less attractive for more conservative investors.

Benefits:

- High yields

- Potential tax benefits

- Attractive entry point relative to history for long-term investors

Risks:

- Low relative yields compared to investment-grade corporates

- Price appreciation may be limited over the short run

- Low ranking in the issuer's capital structure relative to corporate bonds

Preferred security benefits

Preferred securities can offer many benefits for investors, especially those looking for income. These benefits include:

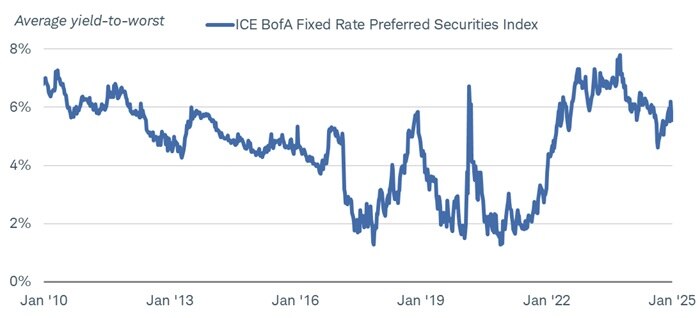

1. High yields. Preferred security yields remain near the high end of their 15-year trading range. The ICE BofA Fixed Rate Preferred Securities Index offered a yield-to-worst of more than 5.5% in mid-January 2025, up from less than 5% in September 2024. The recent move up followed the trajectory of the 10-year Treasury yield on expectations of fewer expected Federal Reserve interest rate cuts this year.

Preferred security yields are still at the high end of the pre-pandemic range

Source: Bloomberg, using weekly data as of 1/24/2025.

Yield-to-worst is the lowest possible yield that can be received on a bond with an early retirement provision. Past performance is no guarantee of future results. Indexes are unmanaged, do not incur management fees, costs, and expenses and cannot be invested in directly.

2. Low prices. The entry point is relatively attractive for long-term investors given the average price of the preferred index is below $92. Keep in mind that most preferreds in the index have par values of $25, but the average price of the index is rebased to $100. The drop in average price over the last few years coincides with the yield index shown above, since price and yields for fixed income investments generally move in opposite directions.

Looking at price alone doesn't tell the whole story, as coupon rates have declined over the years. When the Federal Reserve held interest rates near zero in the years following the 2007-2008 global financial crisis, many issuers redeemed their high-coupon preferreds, replacing them with new issues with lower coupons. The average coupon rate of the ICE BofA Fixed Rate Preferred Securities Index is around 5.4% today, compared with 7.3% back in early 2010. While the price entry point appears attractive, the market pays lower average coupons today.

Preferred security prices are still below pre-2019 levels

Source: Bloomberg, using weekly data as of 1/24/2025.

Past performance is no guarantee of future results. Indexes are unmanaged, do not incur management fees, costs, and expenses and cannot be invested in directly.

3. Potentially preferential tax treatment. Finally, many preferred stocks pay qualified dividends that are subject to lower tax rates than traditional interest income. Investors considering preferreds relative to other investments should always consider what type of account they'll be held in—taxable or tax-advantaged—and if held in taxable accounts, the after-tax yield. Not all preferred stocks or securities pay qualified dividends—some pay interest—so it's important to know what you own and what the tax consequences are. Qualified dividends are generally taxed at 0%, 15%, or 20% rates, depending on income limits. Those lower rates can be an advantage for investors in high tax brackets because the income payments from most taxable bond investments are taxed at income tax rates.

Preferred securities can offer tax advantages

Source: Bloomberg, as of 1/24/2025.

Indexes represented are the Bloomberg US Corporate Bond Index, Bloomberg US Corporate High-Yield Bond Index, and the ICE BofA Fixed Rate Preferred Securities Index. The after-tax column makes the following assumptions: Investment-grade corporate and high-yield corporates include a 37% federal tax, a 5% state tax, and the 3.8% net investment income tax (NIIT). Preferred securities assume a 20% qualified dividend tax and the 3.8% NIIT. Past performance is no guarantee of future results. Indexes are unmanaged, do not incur management fees, costs, and expenses and cannot be invested in directly. For illustrative purposes only.

Preferred security risks

There's no free lunch when it comes to investing, so investors should be cognizant of the risks involved with preferred security investing.

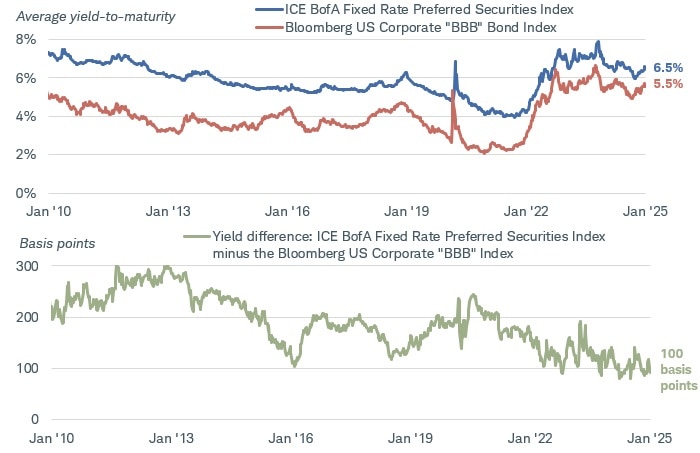

1. Low relative yields. Focusing on the yield alone doesn't tell the whole story. It's important to look at relative yields as well, and the yield advantage that preferreds offer over other similarly rated investments is low today. The average yield-to-maturity of the ICE BofA Fixed Rate Preferred Securities Index is roughly 6.5%. While that looks attractive on the surface, it's not much of an advantage over the 5.5% yield of the Bloomberg U.S. Corporate "BBB" Bond Index.1 The average credit rating of that preferred security index is in the mid "BBB" area, so comparing yields to BBB rated corporate bonds provides a more apples-to-apples comparison.

That approximately 100-basis-point yield advantage that preferreds offer relative to similarly rated corporate bonds is low considering it averaged roughly 200 basis points (or 2 percentage points) from 2010 through 2019. Prior to 2022, that yield advantage hadn't fallen below 100 basis points since the depths of the global financial crisis in 2009, but it has been hovering around that level for the past few years. Given that relatively small yield advantage, more conservative to moderate investors may want to consider investment-grade corporate bonds and the more than 5% average yields they offer rather than reaching for yield with preferreds today.

The extra yield preferreds offer relative to similarly rated corporate bonds has declined

Source: Bloomberg, using weekly data as of 1/24/2025.

Bloomberg U.S. Corporate BBB Bond Index (LCB1TRUU Index) and the ICE BofA Fixed rate Preferred Securities Index (P0P1 Index). The Bloomberg U.S. Corporate BBB Bond Index is a subset of the Bloomberg U.S. Corporate Bond Index holds corporate bonds with BBB ratings. A basis point is one one-hundredth of a percentage point, or 0.01%. Yield-to-maturity was used in this example rather than yield-to-worst to smooth out the effects of call features for many preferred securities. Indexes are unmanaged, do not incur management fees, costs and expenses, and cannot be invested in directly. For illustrative purposes only. Past performance is no guarantee of future results.

2. Higher Treasury yields. A second risk is the potential for Treasury yields to move higher, as preferred securities have high interest-rate risk. Because preferred securities have long maturities (or no maturities at all), changes in the 10-year Treasury yield can influence the price and yield of preferred securities. If long-term Treasury yields rise, the prices of preferred securities may fall.

We see room for the 10-year Treasury to rise to 5% this year given inflation's stickiness, our expectation for a shallower path of rate cuts, and the potentially inflationary impact from the Trump administration's proposed policies.

The last time the 10-year Treasury rose to 5%, the average price of the preferred index dropped to $82. That's not a forecast because other factors can play a role in the price of preferred securities, like the direction of the stock market or overall risk appetite. But the potential for long-term Treasury yields to rise further make us a bit more cautious about considering long-term investments from a tactical approach.

Preferred prices could fall further if the 10-year Treasury yield continues to rise

Source: Bloomberg, using weekly data as of 1/24/2025.

ICE BofA Fixed rate Preferred Securities Index (P0P1 Index) and US Generic Govt 10 Yr Index (USGGYR Index). Past performance is no guarantee of future results. Indexes are unmanaged, do not incur management fees, costs, and expenses and cannot be invested in directly.

3. Low ranking relative to corporate bonds. Most preferred securities rank below traditional debt in the issuer's capital structure. In bankruptcy, for example, corporate bond owners are generally paid before holders of preferred securities.

Although we generally prefer investors consider preferreds with relatively high credit quality whose issuers have investment-grade ratings, that low ranking often means more volatility. It also means that preferreds tend to be correlated to the stock market as well as the bond market. If we experience a period of stock market volatility or large price declines, preferred security prices would likely follow suit.

Finally, an expected focus on deregulation from President Donald Trump is a wild card. It can be a benefit over the short run but a risk over the long run. By rolling back regulations and reducing the amount of capital on hand at a given financial institution, there may be more money available to pay dividends on preferred securities. That can be a benefit. But if banks or other preferred security issuers don't have as much capital on hand, it means they'd likely be less prepared to navigate a slowing economic environment or one where loans sour and delinquencies rise. Bank capital ratios have already declined from their recent highs, and they may continue falling. That can be a risk over the long run.

Bank capital ratios are near the low end of their four-year range

Source: St. Louis Federal Reserve and the Board of Governors of the Federal Reserve System, using quarterly data as of 3Q2024.

Financial Soundness Indicator; Regulatory Tier 1 Capital as a Percent of Risk-Weighted Assets.

What to consider now

Investors that are looking for income and are willing to take some risk for higher yields could consider preferreds. Investors with more conservative to moderate risk tolerances might want to consider investment-grade corporate bonds instead. Investment-grade corporate bonds currently offer average yields of 5% or more with less credit risk than preferreds.2 For those considering preferreds, we always suggest that they be considered long-term holdings given their long maturities.

There are a number of ways to invest in preferred securities. Schwab clients can use the Preferred Shares Screener when looking for individual preferreds, or can explore funds on the ETF or Mutual Fund pages; preferred funds can be found under the Morningstar category of "Preferred Stock." You can also consider a separately managed account.

1 The Moody's investment grade rating scale is Aaa, Aa, A, and Baa, and the sub-investment grade scale is Ba, B, Caa, Ca, and C. Standard and Poor's investment grade rating scale is AAA, AA, A, and BBB and the sub-investment-grade scale is BB, B, CCC, CC, and C. Ratings from AA to CCC may be modified by the addition of a plus (+) or minus (-) sign to show relative standing within the major rating categories. Fitch's investment-grade rating scale is AAA, AA, A, and BBB and the sub-investment-grade scale is BB, B, CCC, CC, and C.

2 Source: Bloomberg. Average yield-to-worst of the Bloomberg US Corporate Bond Index was 5.4% on January 25, 2025.